A vision for Climate Units to fund the net-zero transition

Rethinking Climate Finance

How do we solve climate change? How do we finance the transition to a low-carbon economy?

Over the past two decades, carbon credits have emerged as one of the only climate finance instruments to scale globally. The premise is elegant in its simplicity: any project that reduces or removes carbon emissions earns, and any polluter who emits must pay. The potential for transactions from polluters to solutions is vast, with estimates suggesting it could reach hundreds of billions of dollars annually.

Yet, after a period of explosive growth from 2020 to 2022, the momentum stalled. Prices fell, and confidence wavered. Two forces converged to halt the expansion.

A Double Blow: Geopolitics and Growing Scepticism

First, global crises—including wars and geopolitical instability—pushed climate action down the priority list for citizens and policymakers alike.

Second, carbon credits found themselves mired in controversy. Critics raised concerns:

- Ethical Dilemmas: Should climate change be addressed through market mechanisms that effectively place a price on nature?

- Moral Hazard: Do carbon credits provide a license to pollute, undermining the incentive to cut emissions at source?

- Quality and Trust: Are current credits truly delivering the climate impact they claim—with sufficient integrity, transparency, and verifiability?

The Carbon Paradox: Controversy Rooted in Contradictions

On the Carbon Paradox platform, we argue that these controversies are not incidental—they stem from profound, often unsolvable paradoxes within the system itself. These tensions can trap the discussion in a spiral of criticism and inaction.

But should these challenges lead us to abandon carbon credits altogether? Doing so would mean discarding the only scalable climate finance tool we have—without a viable replacement.

To unlock its full potential, all stakeholders—governments, civil society, academia, and the private sector—must converge around a renewed vision for the instrument.

Toward a New Framework: Five Core Principles for Climate Units

In the climate fiction novel The Carbon Paradox, we propose a new foundation rooted in five guiding principles, how a result-based climate finance mechanism could scale again, fully aligned with Article 6 of the Paris Agreement.

First, we recommend retiring the term “carbon credit.” The word credit implies a “right to pollute”—a misleading and ethically charged framing. Instead, we propose the term “climate unit,” which focuses on what really matters: the quantifiable climate outcome.

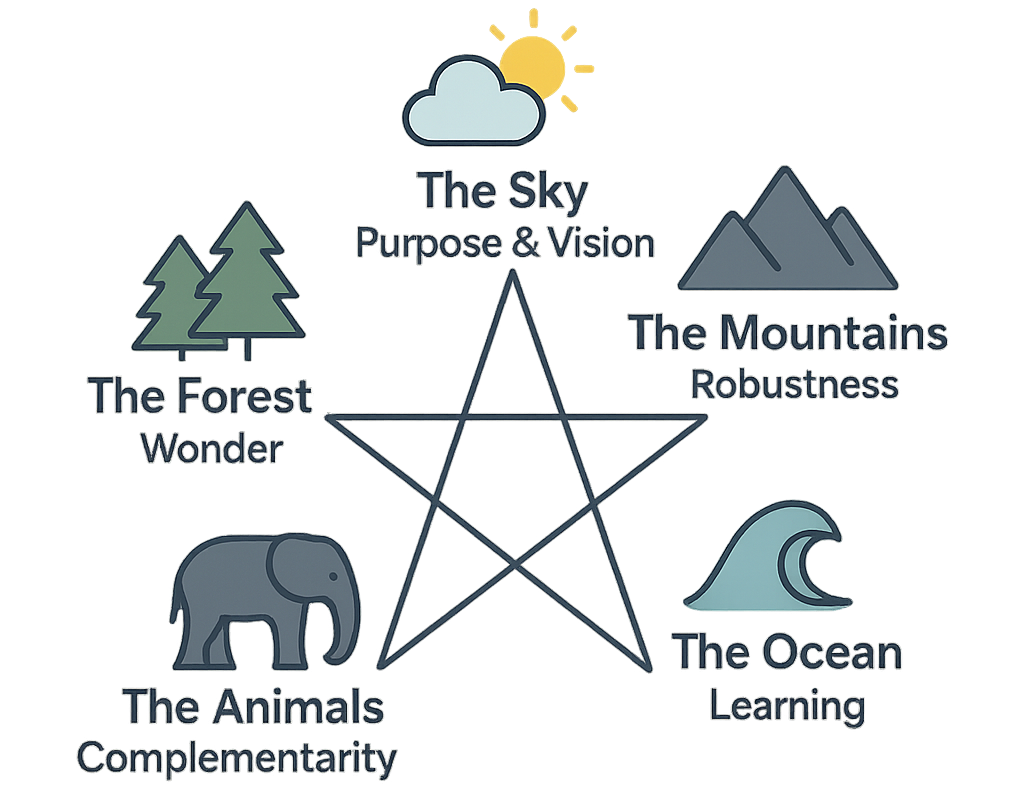

The framework is built around Five Elements—a new compass for climate finance that restores trust, transparency, and climate integrity.

- The Sky—Purpose and Vision

Climate Units must always serve the purpose of increasing climate ambition—not reducing it. They should drive emissions down in the most effective, most meaningful ways. They must never be used to replace responsibility, or delay action. They must always add to a climate target—never substitute for one.

- The Animals—Complementarity

Climate Units are just one climate solution among many. Like a single species in the jungle, they play a role—but only in harmony with the others. You can’t solve climate change with Climate Units alone. But without them, you lose a powerful opportunity to get closer to the goal.

- The Mountains—Robustness

Robustness, transparency, and regulation must underpin each Climate Unit. Just as mountains stand firm against wind and time, Climate Units should be grounded in strong, reliable systems. Wherever possible, their creation and use should be regulated by governments and guided by international principles—ideally those agreed upon under the United Nations’ Paris Agreement. Instead of being scattered and fragile, Carbon Units must become solid. Like rocks.

- The Forest—Wonder

The forest stands for wonder. For beauty. For excitement, but this wasn’t always the case. For much of human history, forests were places of danger and mystery, but they also provided our sustenance. Now, we also see them as sources of inspiration and joy. Climate action shall inspire us, challenge us to innovate, to create, and to cooperate across all borders.

- The Ocean—Learning

Climate Units will never be perfect. They are riddled by underlying paradoxes, some of which will always remain. But like the ocean, they offer vast opportunities—if we’re willing to learn, adapt, and evolve.